Increasing penalties for non-payment of the National Minimum Wage

The government has announced a number of measures to ensure all employees receive the pay they are entitled to, with specific warning to employers who continually ignore the legal requirement to pay employees the National Minimum Wage.

The measures include:

• Increasing the penalties for non-payment of the National Minimum Wage

• Establishing a new team to track and implement criminal prosecutions of those who deliberately do not comply

• Disqualifying anyone found guilty from being a company director for up to 15 years

The last twelve months, the HMRC has investigated 2204 cases, with arrears found in 735 cases for 26,318 workers amounting to over £3.29 million missing payments. The total penalties to businesses have so far toppled £930,000.

In the same week as the government cracked down on non-payments of minimum wage, the Business secretary, Sajid Javid has launched investigation into abuse of tipping, following accusations that some major restaurant chains are withholding a proportion of tips to cover what they have termed ‘administration costs’. The majority of customers who leave tips expect that the voluntary payments go to the waiter or waitress who served them, and not the employer. As such, while no legal transgression has taken place, there is certainly a moral stance that the government wants to be seen as endorsing.

The extent of government intervention into the tipping crisis is unsure, but it is expected they will have some bearing on reframing the code of conduct between employers and employees when it comes to remuneration. Their stance, however, is a considerably more resolute and dominant on the issue of non-payment of minimum wage, with plans to ‘get tough’ on employers who continue to avoid payment. Plans include penalties which will see employers pay double of what they do now, with an overall maximum penalty of £20,000 per worker who has not received a fair pay.

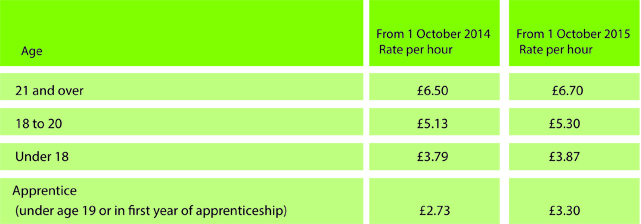

A reminder of the National Minimum Wage (NMW) regulations depend on age, but there is also a special rate for apprentices who are under the age of 19 or are in the first year of their apprenticeship. The table below summarises the position.